wa vehicle sales tax calculator

Curious about car sales tax in Washington. To calculate sales and use tax only.

Car Tax By State Usa Manual Car Sales Tax Calculator

Use this search tool to look up sales tax rates for any location in Washington.

. If sales tax was not paid at the time of purchase use tax applies at the time the vehicle is registered with the Department of Licensing. 635 for vehicle 50k or less. Any caravan defined as a trailer including a camper trailer permanently fitted for human habitation in the course of a journey is exempt from the payment of Vehicle Licence.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Calculating Sales Tax Summary. Use our online sales tax calculator then speak with the auto finance experts at our vw dealer near marysville wa.

Bremerton in Washington has a tax rate of 9 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Bremerton totaling 25. The combined rate used in this calculator 86 is the result of the washington state rate 65 the pasco tax rate 21. 425 Motor Vehicle Document Fee.

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA. Car tax as listed. Vehicle Sales Tax Calculator.

I would like to GO GREEN and receive emails instead of mailing me reminders. The rate is 003 of the net price paid by the purchaser. A business selling motor vehicle fuel is allowed a deduction from the BO retailing tax for the combined amount of state and federal fuel taxes paid.

This would happen if a vehicle was. Car Loan Calculator Detailed for Washington. You can find more tax rates and allowances for Bremerton and Washington in the 2022 Washington Tax Tables.

On top of that is a. In the case where a vehicle is purchased more than 2000 below the fair market value of the vehicle determined by pricing guides like Kelley Blue Book the state will assess the tax you owe on the average fair market value. Decimal degrees between 450 and 49005 Longitude.

Find your state below to determine the total cost of your new car including the. According to the Sales Tax Handbook a 65 percent sales tax rate is collected by Washington State. This would occur if a vehicle was purchased from a private party or if it was purchased outside of Washington.

Decimal degrees between -1250 and -116. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Washington local counties cities and special taxation districts. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

2022 Business Information Systems. The 99301 pasco washington general sales tax rate is 86. A deduction is also allowed under retail sales tax for the total amount of motor vehicle fuel sold at the.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. The states base sales tax rate is 65.

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. What rate do I pay. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle.

The tax amount is based upon the value of the vehicle at the time of purchase and is the same retail sales tax of 65. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. This deduction is itemized on the deduction detail page 0205 Motor Vehicle Fuel Tax.

This tax is in. DOL fees are about 613 on a 39750 vehicle based on a flat fees that fluctuate depending on vehicle. Washington State Vehicle Sales Tax on Car Purchases.

WarranteeService Contract Purchase Price. Use tax is paid at the time a vehicle is registered with the Department of Licensing if sales tax was not paid at the time the vehicle was acquired by the current owner. In our calculation the taxable amount is 37900 which equals the sale price of 39750 plus the doc fee of 150 minus the trade-in value of 2000.

775 for vehicle over 50000. Washington has a 65 statewide sales tax rate but also has 105 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2368 on. To calculate sales and use tax only.

Skip to main content. Vehicle licence duty calculator 20212022 Driver and Vehicle Services is required by the Duties Act 2008 to collect vehicle licence duty when a vehicle is licensed or its licence is transferred. KarMART Volkswagen 1725 Bouslog Road Directions Burlington.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

Washington Sales Tax Small Business Guide Truic

2021 Arizona Car Sales Tax Calculator Valley Chevy

Washington State Annual Registration Rta Tax Toyota Tundra Forum

Woocommerce Sales Tax In The Us How To Automate Calculations

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

The King County Washington Local Sales Tax Rate Is A Minimum Of 6 5

Car Tax By State Usa Manual Car Sales Tax Calculator

Washington Sales Tax Guide And Calculator 2022 Taxjar

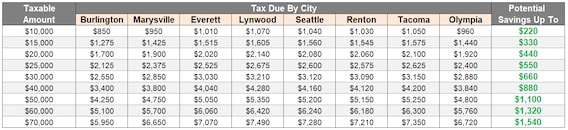

Auto Sales Tax Calculator Buy A Vw Near Marysville Wa

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Sales Tax Calculator Reverse Sales Dremployee

What Is The Washington State Vehicle Sales Tax

Solving Sales Tax Applications Prealgebra

Dmv Fees By State Usa Manual Car Registration Calculator

Washington State Annual Registration Rta Tax Toyota Tundra Forum